Financing Expectations

Wessex Capital Investments manages more than $750 million in real estate assets throughout the Mid-Atlantic and Southeastern United States, primarily within senior housing. We continue to build our portfolio one investment at a time, concentrating strategic efforts on opportunities that best align with our investment principles. Our focus has allowed us to assemble a diverse platform of high-quality assets that yield reliable and emergent cash flows. Our strong market insight is bolstered by unparalleled access to appreciable acquisition opportunities. Wessex also maintains excellent performance with our careful accumulation of long-term quality assets predicated on consistent and predictable gains.

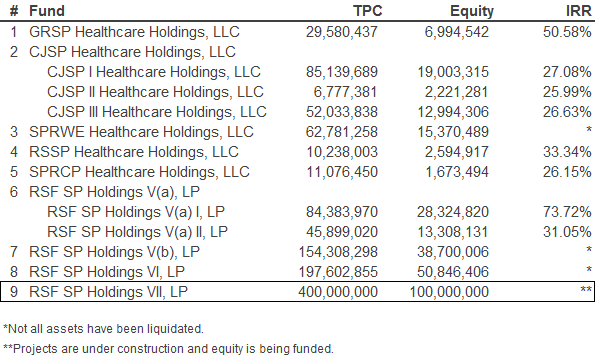

Investment Funds

Since 2003, Wessex Capital Investments has raised capital with investors in nine funds totaling over $290 Million in equity. In its current fund (RSF SP Holdings VII, LP) Wessex has received commitments for $100 Million in equity which will provide for the construction of $400 Million in new projects.

With our extensive history of providing exceptional returns to our investors, Wessex has financed expectations to provide maximum return on investment even in times of economic recession. Our investors realize returns created by our expertise in both raising and allocating capital as well as managing assets. Our tactical agility has solidified long-term relationships with our private equity partners, thus creating a steadfast source of capital for future investments.